‘PH ripe for open finance’

BSP, UBX, ECCP-SCOFFI commit to collaborate to leverage open finance to drive inclusion

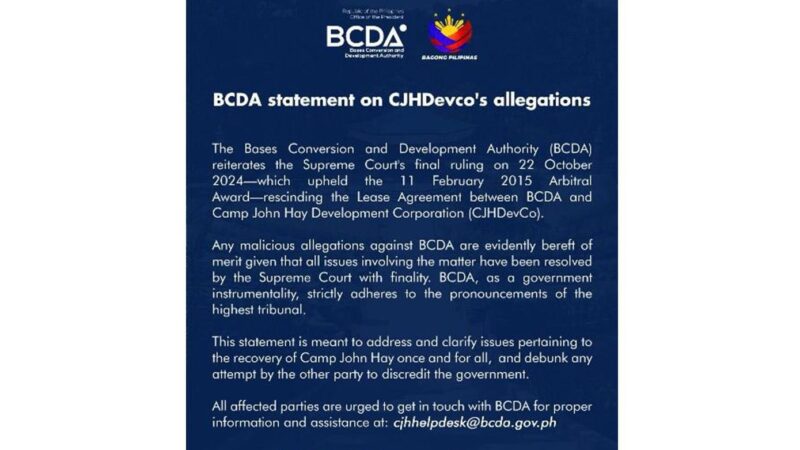

In photo: (L to R): Mr. Mark Anthony Valino, VP for Investments, Pru Life UK; Mr. Jaime Garchitorena, Managing Director for Open Finance, UBX Philippines; Hon. Ferdinand George Florendo, Deputy Commissioner, Financial Examination Group of Insurance Commission; Hon. Chuchi Fonacier, Deputy Governor, Bangko Sentral ng Pilipinas; Mr. Eng Teng Wong, Vice-Chair, Special Committee on Open Finance and Financial Inclusion, ECCP; Mr. Anatoly Dela Cruz Gusto, Bank Officer V, Fintech Innovation and Policy Research Group, Technology Risk and Innovation, Bangko Sentral ng Pilipinas. (UBX File Photo)

UBX, the leading open finance platform in the Philippines, the Bangko Sentral ng Pilipinas (BSP) and members of the European Chamber of Commerce of the Philippines’ (ECCP) Special Committee on Open Finance and Financial Inclusion (SCOFFI) committed to collaborate closely to leverage open finance in driving financial inclusion further in the country.

In a recent Kapihan Session organized by the ECCP-SCOFFI, UBX Managing Director for Open Finance Jamie Garchitorena, BSP Deputy Deputy Governor Chuchi Fonacier highlighted the readiness of the Philippines in embracing open finance.

According to Fonacier, the country already has the necessary tools to adapt to the Open Finance Framework, a policy that is already being implemented by the central bank alongside key players in the finance industry.

“It is only a matter of providing the right information on why it is necessary, as well as how this would benefit them (Filipinos). Very critical here is the consent of the customer to share his data or personal transactions with any of the financial institutions. There is an emphasis on consent. What benefit will they derive from sharing? Trust is really key to all of this, it is critical.” Fonacier said.

Earlier this year, the BSP called on various financial service providers in the country to participate in the pilot run of its open finance ecosystem within a sandbox and proof-of-concept framework, pursuant to the administration’s goal of digitally transforming the economy.

By reducing transaction costs through consent-driven data portability, interoperability, and collaborative partnerships among financial institutions and third-party providers (TPPs), open finance seeks to provide customers with a better banking experience.

Hence, industry players are able to create customer-centric products and provide better access to critical financial services such as savings, insurance, and credit.

UBX Managing Director for Open Finance Jamie Garchitorena said that from a regulatory and business perspective, the Philippines is more than ready for this development. However, it is also important to consider the circumstances of the consumers.

“Digital is how businesses like insurance leverage off large masses of data to create new products and services at a cost-efficient level. It is also how you protect yourself and customers from fraudulent transactions. We should look at readiness from different perspectives: the consumer may or may not be ready from an ultimate benefit perspective, and even an access perspective.” Garchitorena said.

Ultimately, the goal of open finance is to close the gap when it comes to access to formal financial institutions. In its National Strategy for Financial Inclusion, the BSP aims to reduce financial disparities, increase financial capability of consumers, and improve access to finance for micro, small, and medium enterprises (MSMEs) through the use of technological advancements and deepened multi-sector partnerships. The BSP targets to digitalize 50% of retail transactions and bring at least 70 percent of adult Filipinos into the formal financial system by the end of this year.

The Open Finance Framework of the BSP was issued under its Circular No. 1122 issued in June 2021, allowing for customer consent-driven data sharing among institutions that follow the same data security standards. Thus, customers have greater control over their own data while enabling third party providers to have access to their data across multiple financial products and services.

“At the end of the day, it really goes down to these institutions serving the consumers. As advocates for customer centricity, go where you could get the best customer experience,” Fonacier said.

ECCP-SCOFFI Vice Chairman and Pru Life UK President and CEO Eng Teng Wong and Insurance Commission Deputy Commissioner Ferdinand George Florendo also signified their commitment to strengthen industry-wide partnerships to promote financial inclusion, leveraging open finance.

Financial inclusion plays a critical role in promoting long-term and equitable national growth. With a booming economy, it ensures equitable access to financial services in the name of public welfare.

“The journey towards financial inclusion is not solely dependent on government undertakings. Without the products made available to the public, and without the public who takes part in accessing these instruments, financial inclusion would never be truly achieved. Thus, we acknowledge the importance of collaborating with the BSP and other stakeholders to work towards this goal,” Garchitorena said.

ECCP-SCOFFI was established to promote financial inclusion in the Philippines. It was established to provide an avenue for stakeholders to discuss issues and solutions to the status quo while fostering financial inclusion through technology.

Together with UBX, the leading open finance platform in the Philippines, the Special Committee has aided the BSP when it comes to formulating open finance standards and procedures for better implementation. ### (PR)